Step 1

Eligibility check

Check your student finance eligibility for up to €1300 in less than 3 minutes

Step 2

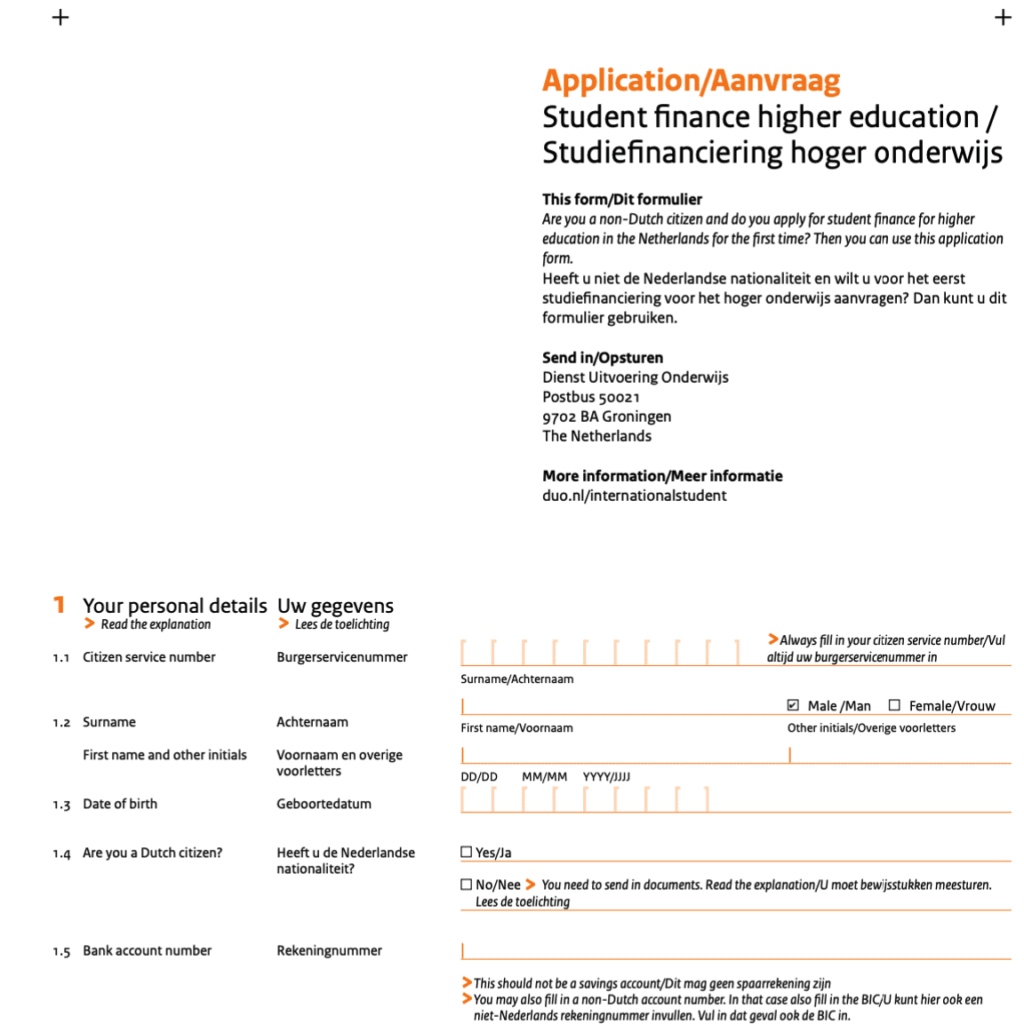

Application

Get an expert-prepared application and full support throughout the process

Step 3

Results

We guarantee: You’re charged only after we’ve secured your grants¹

- Join over 1,000 international students helped

- 95% success rate

- Application submitted in 24 hours

- Reduced processing time by up to 70%

- Rejected application handled

Get student finance from DUO as an international student

Guaranteed results – no cure, no pay

Start Your Student Finance Application

Struggling with student funding paperwork? myStudentFinance completes or coaches you through every Basic or Supplementary Grant, Tuition Fee Loan and Travel assistance form. Enjoy swift, error-free applications, status tracking, and expert tips that maximise approval and minimise stress — start today.

Get a Fast-Track Application and Support

We secure every essential document and form on your behalf, providing detailed, step-by-step guidance that streamlines the application and typically shortens processing by an average of 8 weeks – yet if an unjustified rejection still occurs, we’ll escalate your case to our partnered law firms for complimentary, pro-bono representation.

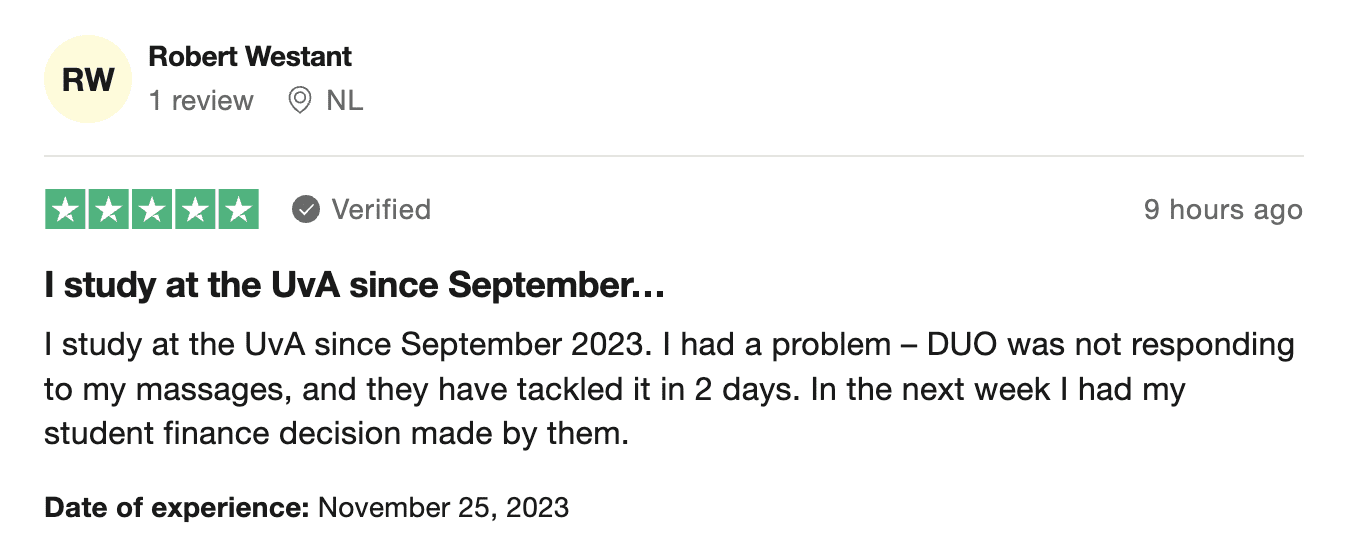

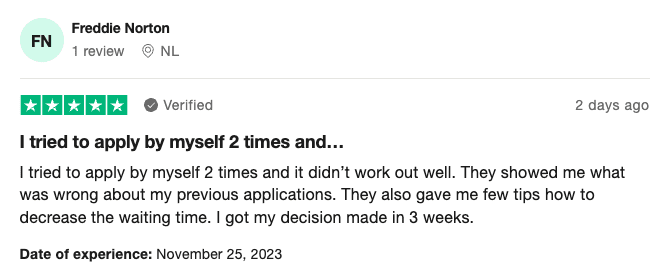

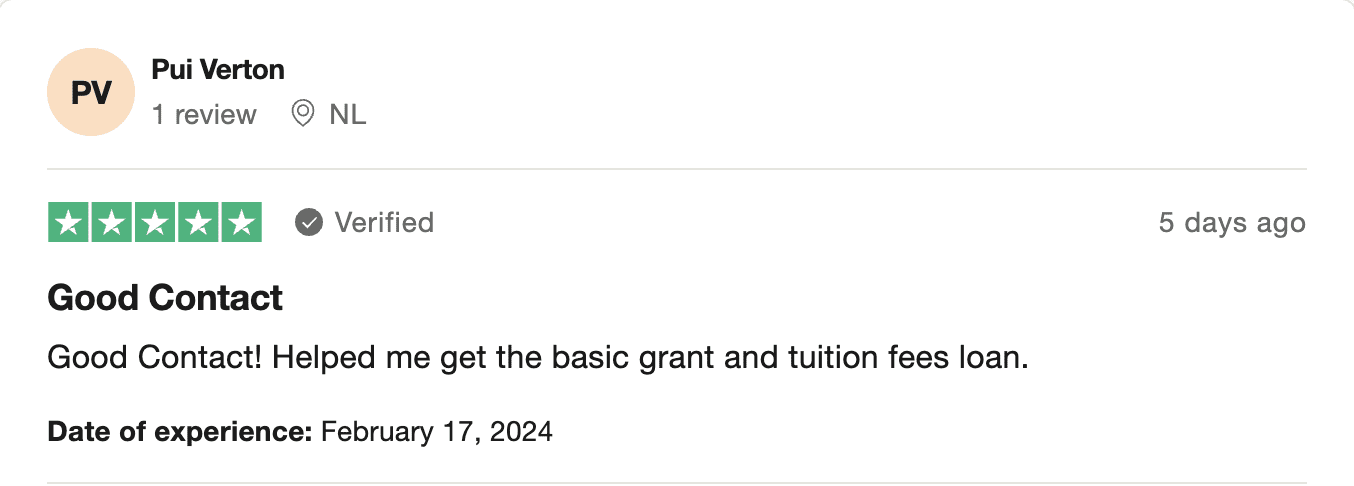

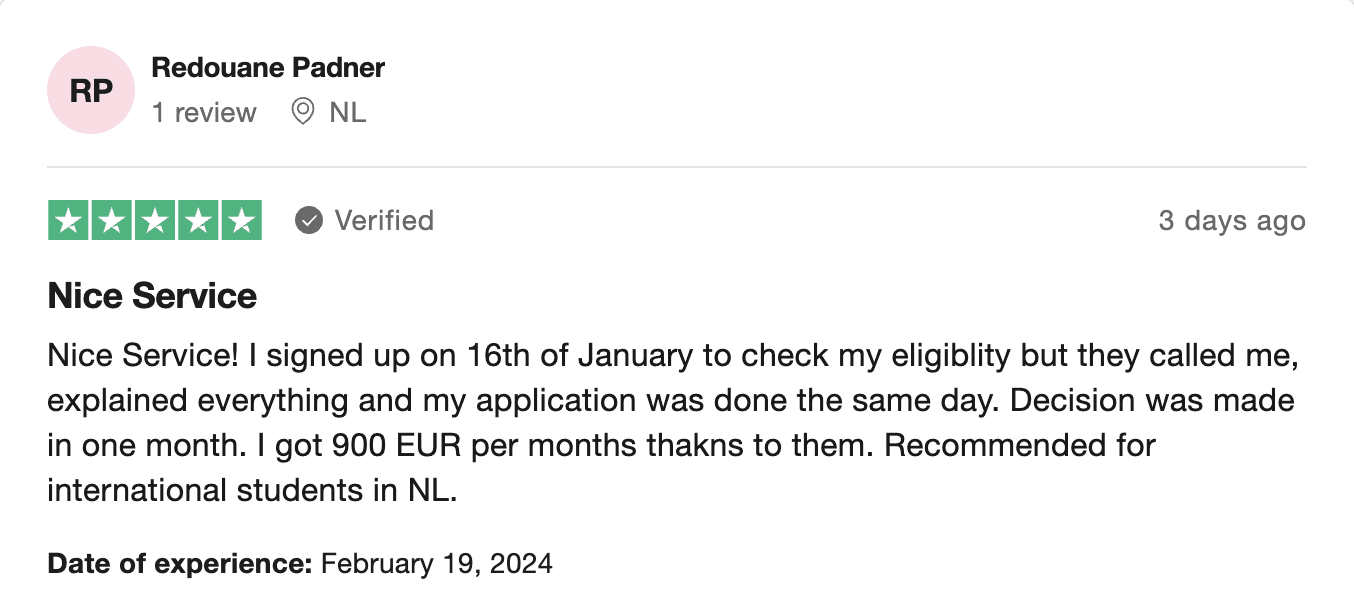

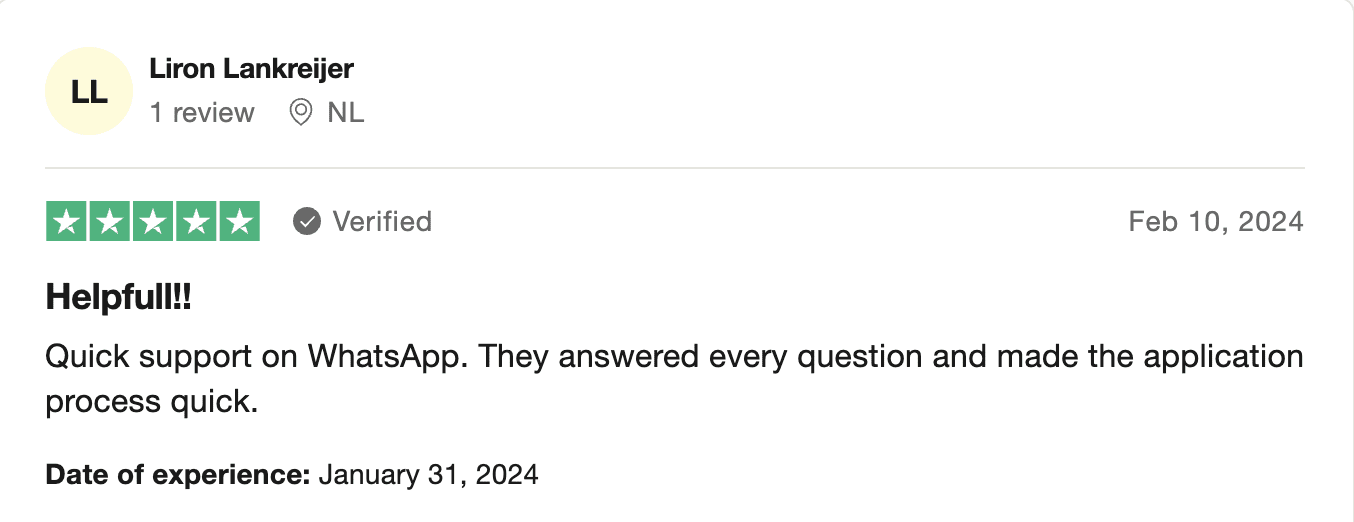

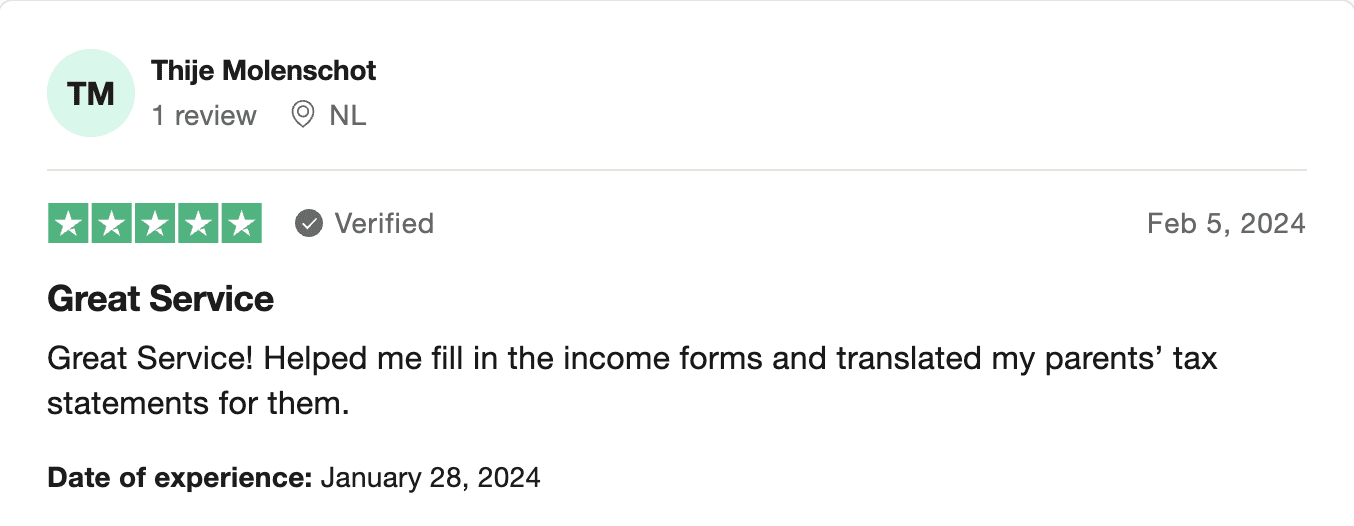

Real success stories from our clients

Choose us for trusted service, backed by glowing reviews. Based in Tilburg, NL, we commit to top-notch quality in every interaction.

No cure, no pay - student friendly pricing

€0.00

Due today

- Your application made by an expert

- Unlimited consultations & document reviews

- Complete set of official authorized application forms in English

- Student finance rejection handled: legal support from our partners

- Student finance granted? We take only 59.99% (incl. vat) of your first student finance payout, no subscription

- Application rejected? No cost to you

¹Note: In rare instances of intentional agreement breach, other fees may apply. Read more about our fees in the Service Agreement.

FAQ

Our Service

We offer personalized guidance and support to international students seeking funding for their studies. We stay up-to-date on the latest funding opportunities and can help navigate the complex application processes. We work closely with each student to understand their individual needs and goals, and we tailor our advice to their specific situation.

As stated in the Pricing section, our services are completely free until you receive your first student finance payment. At that point, we collect a one-time fee of 59.99% (incl. vat) of your payment amount, which will vary depending on the size of your student finance award.

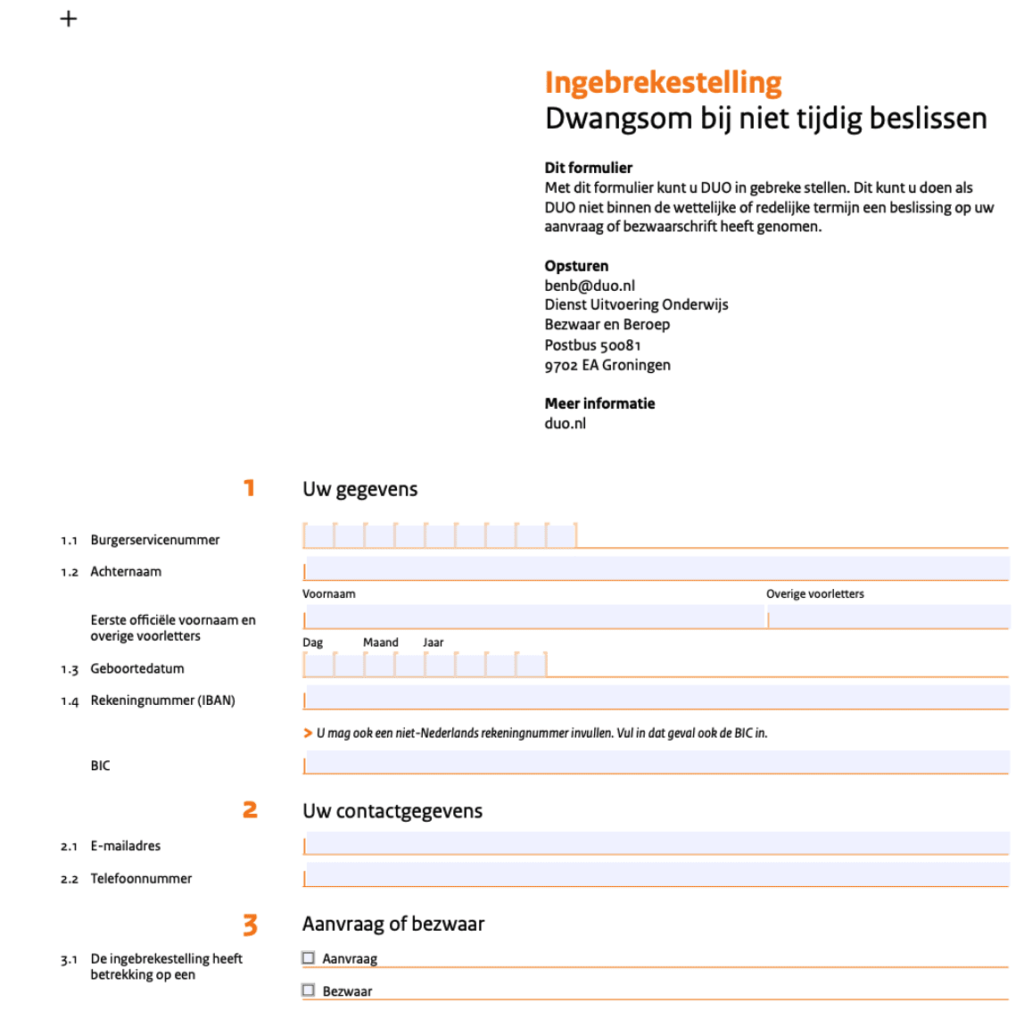

At times, DUO may reject applications that are legally eligible for student finance. In such cases, we help you to fill out and submit a complaint. This often results in a successful resolution. However, if your application is still rejected despite being eligible, we can provide you with details of law firms that specialize in assisting international students. These firms have extensive experience in handling such cases and typically charge a fee only after the case is won, which means you do not have to worry about the high costs of legal assistance.

We can assist you with the entire application process, from determining your eligibility to filling out the necessary forms and submitting the required documentation. We will also provide you with tips and strategies to increase your chances of success.

Unfortunately, we cannot guarantee that you will receive a grant or scholarship. However, we will work with you to maximize your chances of success.

Yes, we work with international students from all countries who are studying in the Netherlands or Europe.

The application process can vary depending on the specific grant or scholarship program you are applying for. However, we work to streamline the process and minimize waiting times as much as possible.

Simply contact us through our website or by phone, and we will schedule a consultation to discuss your needs and how we can help.

We are always available to answer any questions or concerns you may have. You can contact us by phone, email, or through our website.

Student finance

Student finance is a financial support provided by the Dutch government to eligible students to help them cover the costs of their studies, including tuition fees, living expenses, and study materials.

To be eligible for student finance in the Netherlands, you must meet certain criteria, such as being a Dutch citizen or meeting certain residency requirements, being enrolled in an eligible course or program at a recognized educational institution, and meeting certain income and asset limits.

The main types of student finance available in the Netherlands are the basic grant, supplementary grant, and student loan. The basic grant is a monthly payment to help cover living expenses, while the supplementary grant is an additional payment for students from low-income families. The student loan is a loan that must be repaid after graduation.

To apply for student finance, you must first create an account on the DUO website and fill out an application form. You will need to provide personal information, information about your education, and information about your income and assets. You may also need to provide additional documents, such as proof of enrollment or proof of income.

It is recommended that you apply for student finance as soon as possible, ideally three months before the start of your course or program. This will give DUO enough time to process your application and ensure that your payments are made on time.

The amount of student finance you can receive depends on various factors, such as your age, living situation, and income. You can use the DUO calculator on their website to get an estimate of the amount you may be eligible for.

No, this is currently not possible.

If your situation changes during your studies, such as a change in your income or living situation, you must report this to DUO as soon as possible. Depending on the changes, your student finance payments may be adjusted.

You must start repaying your student loan within two years of the end of your studies. The exact repayment schedule and amount will depend on various factors, such as the size of your loan and your income after graduation.

¹Note: In rare instances of intentional agreement breach, other fees may apply. Read more about our fees in the Service Agreement.